IEC Code Online Application Help

In today's fiercely competitive business landscape, the desire to expand beyond domestic boundaries is a shared goal. Thanks to the advancements in technology and the internet, conducting business globally has become more accessible than ever before. However, before venturing into the global market, one must navigate through various procedures, laws, and obtain the necessary registrations and licenses. Among these prerequisites, the Import Export Code (IEC) license, also known as the Importer-Exporter Code, holds utmost importance for those involved in importing to or exporting from India.

The IEC, a 10-digit code with lifetime validity, is an essential requirement for individuals seeking to kick-start their import/export business in the country. It is issued by the Director General of Foreign Trade (DGFT). Importers heavily rely on the IEC to bring goods into the country, while exporters require it to avail benefits from DGFT for export schemes and other opportunities. Without the IEC, importers face restrictions in importing goods, and exporters cannot access the benefits provided by DGFT for their export initiatives.

-

Importers need the IEC when clearing their shipments through customs, as it is required by customs authorities.

-

When importers send money abroad through banks, the IEC is needed by the bank.

-

Exporters require the IEC when sending their shipments, as it is required by the customs port.

-

When exporters receive money in foreign currency directly into their bank accounts, the IEC is required by the bank.

The process of registering for IEC (Import/Export Code) involves the following steps:

-

Visit the DGFT Website.

-

On the homepage, click on the 'Services' tab.

-

From the drop-down list, select the 'IEC Profile Management' option.

-

A new page will open. On that page, click on the 'Apply for IEC' option.

-

-

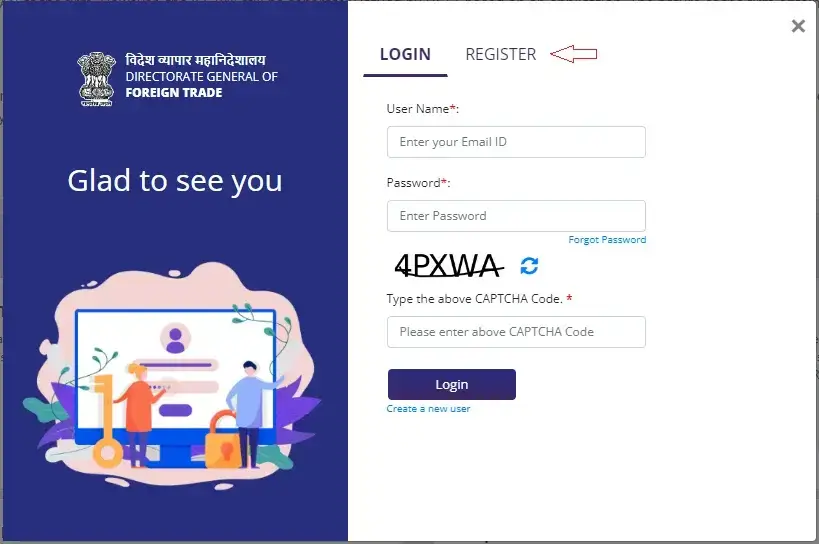

After successfully registering on the DGFT website, log in by entering your username and password.

-

On the DGFT website, click on the 'Apply for IEC' option.

-

Fill out the application form in the ANF 2A format, upload the required documents, make the necessary fee payment, and then click on the 'Submit and Generate IEC Certificate' button.

-

The DGFT will generate your IEC code. Once the code is generated, you can print out your certificate for future reference.

To complete the registration process for IEC (Import Export Code), the following documents are necessary:

-

Copy of PAN Card: Provide a copy of the PAN Card belonging to the individual, firm, or company.

-

Identification Document: Submit a copy of the individual's voter ID, Aadhar card, or passport.

-

Cancelled Cheque: Include copies of cancelled cheques from the current bank accounts of the individual, company, or firm.

-

Proof of Business Premises: Provide a copy of the rent/lease agreement or an electricity bill to verify the business premises.

-

Self-Addressed Envelope: Prepare a self-addressed envelope for the delivery of the IEC certificate via registered post.

IEC registration offers several benefits that contribute to the growth and success of your business:

With IEC, you can expand your business by taking your products or services to the global market. It opens up opportunities for international trade and allows you to reach a wider customer base.

Companies with IEC registration can enjoy various benefits related to their import and export activities. These benefits include advantages provided by the DGFT, Export Promotion Council, Customs, and other relevant entities. IEC registration enables you to access favourable schemes, incentives, and support available for international trade.

Unlike many other registrations, IEC does not require the filing of returns. Once you obtain the IEC, there is no need to undergo a cumbersome return filing process to maintain its validity. Even for export transactions, there is no requirement to file returns with DGFT.

Obtaining an IEC code is a relatively straightforward process. After submitting your application to the DGFT, you can expect to receive the IEC code within a period of 10 to 15 days. No proof of export or import is necessary for obtaining the IEC code, simplifying the process further.

The IEC code has lifetime validity, eliminating the need for renewal. Once obtained, the code can be used indefinitely for all your export and import transactions. You can conduct international trade smoothly without the hassle of renewing the IEC periodically.

Overall, IEC registration provides a favourable business environment, streamlines procedures, and offers long-term benefits for businesses engaged in import and export activities.

There are specific cases where Import-Export Code (IEC) is not mandatory as per the latest government circular:

-

Personal Use of Goods: If the goods being imported or exported are solely for personal use and not intended for any commercial purposes, IEC registration is not required. This exemption applies to individuals who are importing or exporting goods for their personal needs and not for any business-related activities.

-

Government Departments, Ministries, and Charitable Institutions: Import and export transactions carried out by Government of India departments, ministries, and notified charitable institutions do not necessitate obtaining an Import-Export Code (IEC). These entities are exempted from the requirement of IEC for their import and export operations.

It's important to note that these exemptions are based on specific circumstances outlined in the government circular. Traders and entities falling under these categories can conduct import and export activities without obtaining an IEC, provided they meet the criteria mentioned above.

Yes, obtaining an Importer-Exporter Code (IEC) is mandatory for both importing to and exporting from India. It serves as a crucial business identification number for import/export operations. Unless specifically exempted, individuals or entities cannot engage in import or export activities without an IEC. However, IEC is not required for services exports, except when the service provider seeks benefits under the Foreign Trade Policy.

The process of obtaining an IEC code usually takes around 10 to 15 days after submitting the application to the Directorate General of Foreign Trade (DGFT). Within this timeframe, the code will be generated and provided to the applicant.

Yes, individuals acting as sole proprietors of a business can obtain IEC registration. They can use either their own name or the name of their company to apply for IEC registration.

To print your IEC certificate, follow these steps:

-

Visit the DGFT website.

-

Click on the 'Services' tab on the homepage.

-

Select the 'IEC Profile Management' option from the drop-down list.

-

A new page will open. Click on the 'Print IEC' option on the page.

-

Verify your details and click on the 'Print IEC' button.

Yes, it is mandatory to update your IEC profile on an annual basis. Failure to update the profile will result in deactivation. However, a deactivated IEC can be reactivated upon successful profile updation. Reactivation is subject to the condition that no other actions violating the provisions of the Foreign Trade Policy have been taken.

No, a Digital Signature Certificate (DSC) is not compulsory for applying for an IEC. The IEC application can be signed through Aadhaar authentication. However, the introduction of DSC in the IEC process aims to strengthen the issuance and modification processes of IEC codes.